Do you know what is a common challenge in the sales world? A sales commission policy structure that’s fair, motivating, and aligns with your business goals. Sales commissions motivate reps by letting them earn more when they sell more. This encourages them to work harder, which helps the business grow. It’s a win-win: reps get higher pay, and the business sees more sales and profits.

To give you a gist, a sales commission policy is like a reward paid to sales reps based on the sales they make. In this blog, we’ll dive into how these commissions work and how they can benefit both sales reps and the business.

Table of Content

What is a Sales Commission Policy?

Benefits of a Well-Structured Sales Commission Policy

Sales Commission Policy Types

Mistakes to Avoid In a Sales Commission Policy

Best Practices For Sales Commission Policy

How To Make A Sales Commission Policy?

Sales Commission Policy Agreement

Sample Sales Commission Policy

What is a Sales Commission Policy?

Benefits of a Well-Structured Sales Commission Policy

Sales Commission Policy Creates A Competitive Spirit :

A little healthy rivalry goes a long way in the world of sales. This is made possible by a commission scheme, which incentivizes representatives to surpass their colleagues, hence increasing the team’s overall productivity.

Sales Commission Policy Drives Focus on Important Business Goals:

Representatives can ensure that their efforts support wider business aims by focusing on selling the most profitable or strategically significant items or services by coordinating commission schemes with company objectives.

Sales Commission Policy Encourages Accountability and Responsibility:

A commission policy makes it apparent that each person’s earnings are the consequence of their own hard work and accomplishments. This transparency instills a sense of responsibility in team members to fulfil and surpass their sales targets.

Sales Commission Policy Types

Flat Rate:

It’s a simple strategy where commission is paid as a set proportion of the selling price. For example, if a salesperson sells something for $100 and the flat rate is 5%, they will get paid $5. This format is easy to use and comprehend.

Tiered Commission:

When sales representatives surpass greater sales benchmarks, their commission rate rises in a tiered structure. Imagine a sales rep earns a 4% commission on all sales they make up to $5,000. Once they sell more than $5,000, their commission rate jumps to 6% on any sales above that. So, if they sell $7,000 worth of products, they earn 4% on the first $5,000, and then 6% on the remaining $2,000. This setup really motivates them to sell more because the more they sell, the higher their commission rate goes.

Commission with Base Salary:

This kind of plan guarantees sales representatives a steady income stream by providing a base salary. It also contains commission payments that are contingent on sales volume, giving an incentive to surpass sales goals. It’s perfect for striking a balance between the need for greater performance and stable income.

Think of it like this: One of your employees, let’s call him Mark, gets a steady paycheck of $2,000 every month, no matter what. Plus, if he sells more, he gets extra money. So, the more he sells, the more he earns on top of his regular pay.

Profit-Based Commission:

Under this deal, commissions are determined by taking each sale’s profit margin into account. This motivates sales representatives to match their attempts with the company’s financial stability by concentrating not just on the quantity of sales but also on marketing more lucrative goods or services.

For example, ‘X’ sales employee is working hard to sell gadgets. Under a Profit-Based Commission plan, that salesperson is earning more by selling higher-profit items. Basically, with a 5% commission, selling a gadget that makes $200 profit means earning $10. So, focusing on profitable items boosts their earnings.

Tiered Revenue Commission:

This structure provides varying commission rates according on sales revenue levels. Sales representatives advance to higher commission levels as their overall sales increase. It’s designed to motivate reps to continuously grow their sales figures, as higher tiers mean higher earnings.

Unlike a Profit-Based Commission where earnings are based on profit, in a Tiered Revenue Commission, a salesperson earns different rates as they sell more. For example, they might earn 5% on the first $1,000 in sales, but this increases to 7% for sales over $1,000. So, the more they sell, the higher the percentage they earn.

Revenue-Based Commission:

The entire amount of money received from sales is used to compute commissions. Since it pays reps according to the total sales value, this is especially beneficial for high-value goods or services since it motivates them to concentrate on large-ticket sales. If a sales rep sells a luxury car for $50,000, and their commission is 10% of the sale’s revenue, they earn $5,000. This plan is great for expensive items because it rewards the total sale value.

Percentage of Sales:

Sales people are paid a fixed proportion of the sales they generate. The kind of product sold and the size of the agreement are two examples of factors that can influence this percentage. The concept is simple to comprehend and establishes a direct correlation between remuneration and sales performance.

Imagine a sales rep has a 6% commission rate. If they sell a piece of furniture for $2,000, they earn $120. This straightforward approach rewards them based on the total amount they sell.

Residual Commission:

After landing a client, sales representatives are still paid commissions on subsequent sales or subscriptions. This promotes the upkeep of maintaining client ties and pays representatives for consistently bringing in repeat business.

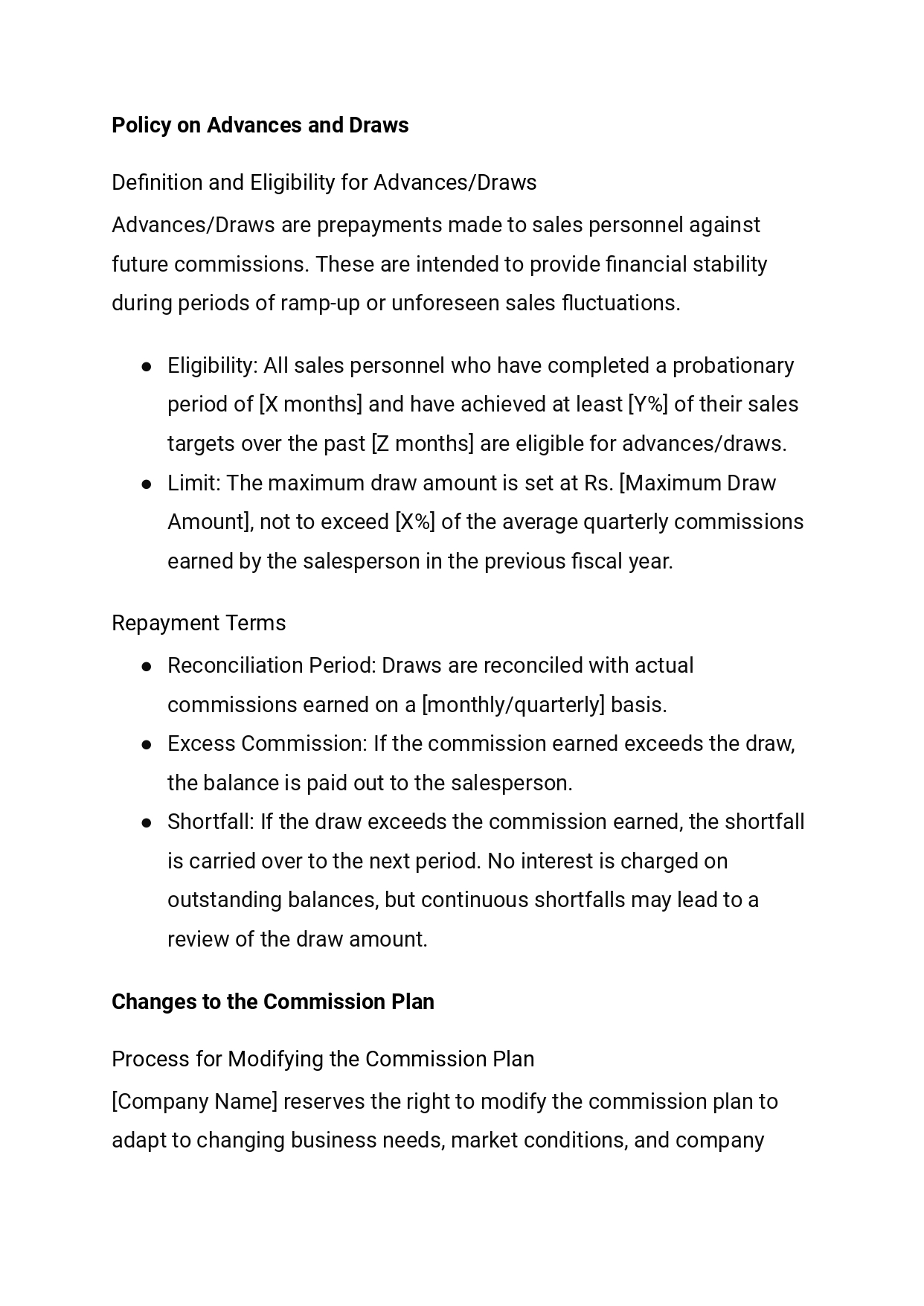

Draw Against Commission:

Under this scheme, salespersons receive an advance on their commissions, which gives them money during slow selling times. The initial payment amount is then deducted from any further commissions that are earned. Although it lessens fluctuations in earnings, it has to be carefully managed to prevent representatives from collecting debt.

Let’s say you run a real estate agency and one of your employees receives a $1,000 advance at the start of the month to cover her expenses. She closes sales of a total of $8,000 in commission by month-end. After repaying the $1,000 advance, she takes home $7,000. This is what draw against commission is .

Team-Based Commission:

Gives the total commission received among team members based on the combined performance of a sales team. This framework, that ties each person’s reward to the team’s overall success, encourages cooperation and teamwork. A team of pharmaceutical representatives makes $300,000 in revenue. Their $21,000 7% commission is split equally among the team members, motivating them to collaborate in order to meet sales targets.

Activity-Based Commission:

This type of compensation is based on particular sales-related tasks like lead generation, appointment scheduling, or product demonstrations. This structure encourages a wider range of sales activities by rewarding efforts that go into making sales rather than just the final transaction. Suppose you run a software company and every software presentation your sales rep has done with a prospective customer earns her $50. So in a month, if she completes 15 demos, she will be earning an extra $750.

Mistakes To Avoid In A Sales Commission Policy

Implementing Generic Commission Structure For All:

Overlooking the fact that different sales roles like inside sales, field sales, or account management, each have distinct responsibilities and targets, is a huge mistake. Using the same commission structure for everyone can be a problem because different sales roles and teams have unique goals and challenges. So matching suitable commission structures to fit different roles and teams will keep them motivated to do more better and make unique contributions to the company’s success.

Failing to Align with Business Goals:

Failing to align sales commission policies with business goals means you are setting up incentives that don’t support your company’s actual goals. For example, if your business aims to enter into a new market or promote a newly launched product, but the commission structure motivates sales reps to focus on the already successful and existing products or markets instead, it’s a mistake.

Making Overly Complex Sales Commission Policy:

Having a sales commission policy that’s overly complex, filled with unnecessary rules and terms, can backfire. In fact, Xactly’s research indicates that clear and simple compensation plans are linked to a 3% higher quota attainment compared to complex ones. Basically, when a policy is too complicated, sales reps will be spending more time decoding their possible earnings than actually focusing on selling and being better at business, negatively impacting their sales efficiency.

Delays In Commission Payments:

Not paying commissions on time can seriously hurt your sales team’s motivation and your business as well. So when incentives are delayed, it sends a message that their efforts or hard work isn’t valued, leading to decreased enthusiasm for selling. On top of increasing sales success, prompt commission payments also help retain top sales people. Sales representatives are more likely to remain dedicated to reaching their goals when they have confidence that they will be paid appropriately and on schedule.

Best Practices For Sales Commission Policy

-

Establish possible, visible, and clear sales goals to provide guidance and inspiration

When creating a sales commission policy, it’s important to set sales goals that are:

Possible: The goals should be achievable. If they’re too hard, sales reps might get discouraged.

Visible: Make sure everyone knows what the goals are. This can be done through regular meetings, emails, or a dashboard that everyone can see.

Clear: The goals should be easy to understand. Avoid complicated targets that might confuse the team.

So by doing this, you are giving your sales team a very clear target to aim for, which appreciates their efforts and keeps them motivated. They know exactly what they need to do, believe it’s going to be achievable, and can see their progress, which inspires them to work harder, better and smarter.

-

Review the ratio of basic pay to commission on a regular basis

The reason this ratio matters is because basic pay gives your sales staff protection and predictability in their finances, whereas commission serves as a reward for achievement, inspiring your group to meet sales goals. For example, while a large base pay and lesser commission could be excellent for stability, they can also reduce the incentive to make more sales.

Conversely, a smaller base pay with a larger possible commission might motivate more aggressive sales techniques, but it could also put workers under some kind of financial strain. The 60:40 ratio is a widely used benchmark for this ratio, according to which base pay accounts for 60% of total compensation and variable pay (commission) for 40%.

-

Make use of CRM systems for precise commission calculations and sales tracking

Without a dependable system, like a trustworthy CRM software, there is a greater possibility of errors in recording sales, which are capable of causing conflicts over commission payments. This can destroy trust and potentially discourage your sales team. So let’s see for example- a CRM program in a high-end real estate company can automatically determine greater commission rates for sales of pricey houses. In order to make sure agents are given adequate compensation for their efforts, it also monitors customer retention and referrals, that is important in high-end markets.

-

Use a tiered commission structure to encourage greater sales

A tiered commission system is an effective sales motivation tool almost like a ladder with each level having better rewards. Sales representatives earn commissions at gradually larger rates as they go through these sales tiers.

This method is very effective because it encourages sales representatives to continue pushing for greater sales. Instead of settling for meeting a minimal goal, they are always motivated to go even further. It’s like you are saying, “The more you sell, the more you earn.”

According to a Harvard Business Review study, companies that use tiered incentive schemes tend to have better overall sales. This is due to their sales teams’ desire to advance to the next ‘tier’ or level, similar to how players strive to advance in video games.

How To Make A Sales Commission Policy?

-

Narrow down your business objectives

Defining your business objectives is the first crucial step in creating a sales commission policy. Ask yourself what is that you wish to achieve – is it increasing overall sales, promoting new products, or expanding into new markets? (it can also have a time duration, a year, month and so on.)

Your commission policy should directly support these goals. For instance, if market expansion is your main goal, then your commission structure might offer higher rewards for sales in new territories. Therefore, understanding your objectives helps in choosing a commission policy that drives the right sales behaviors to achieve these goals.

-

Gather your data about sales teams

Getting to know your sales team’s dynamics, strengths, and weaknesses is extremely essential. So make sure you gather data on their current and past performance, areas of expertise, and what motivates them. Are they driven more by monetary rewards, recognition, or career advancement opportunities? This kind of insight will help you design a commission policy that not only motivates your team but also plays to their strengths. For example, if your team excels in long-term relationship building, a commission structure that rewards long-term client retention might be effective.

-

Look into market rates and standards for your industry

The next step involves looking at what similar companies are offering their sales teams. This way your employees don’t get the impression of your business being unfair towards them.

Hence being aware of industry standards helps in attracting and retaining top sales talent and prevents your team from feeling undercompensated or overworked. For instance, if the standard commission rate in your industry is around 5-10%, setting your rates significantly lower might make it hard to attract skilled salespeople.

-

Decide on a matching commission structure

It is necessary to select just the perfect commission structure. Determine whether a flat rate, tiered, profit-based, or other kind of other compensation structure (listed above) works best for your needs based on your team dynamics and business objectives. Each has benefits and can be applied to inspire various kinds of sales actions.

-

Lay out rules and terms

Clearly define how and when their commissions are paid, and what targets or conditions must be met. And not just vague conditions, they need to be met to the T. This includes setting clear sales targets, explaining how commissions are calculated, and outlining any caps or limits. Just make sure that your policy is documented in a clear, easy-to-understand manner and communicated effectively to the entire sales team.

Suppose a retail company has failed to specify in their policy that commissions would only be paid on completed sales, not just orders taken. This led to confusion among sales staff who expected commissions on orders that were later canceled, resulting in disputes and dissatisfaction.

-

Review and monitor

Finally, make sure your commission policy is being reviewed and monitored on a regular basis. This is not a procedure that can just be set and forgotten; constant tweaking and improvement are needed. Study sales information and sales team input to see if the policy is accomplishing its goals. If some elements of the policy aren’t performing as planned or if the market conditions alter, be ready to make adjustments.

Basically, frequent evaluations guarantee that your commission structure is still competitive, relevant, and useful for inspiring your sales force. By taking a proactive stance, you can adjust the policy to fit changing market conditions as well as internal performance measurements.

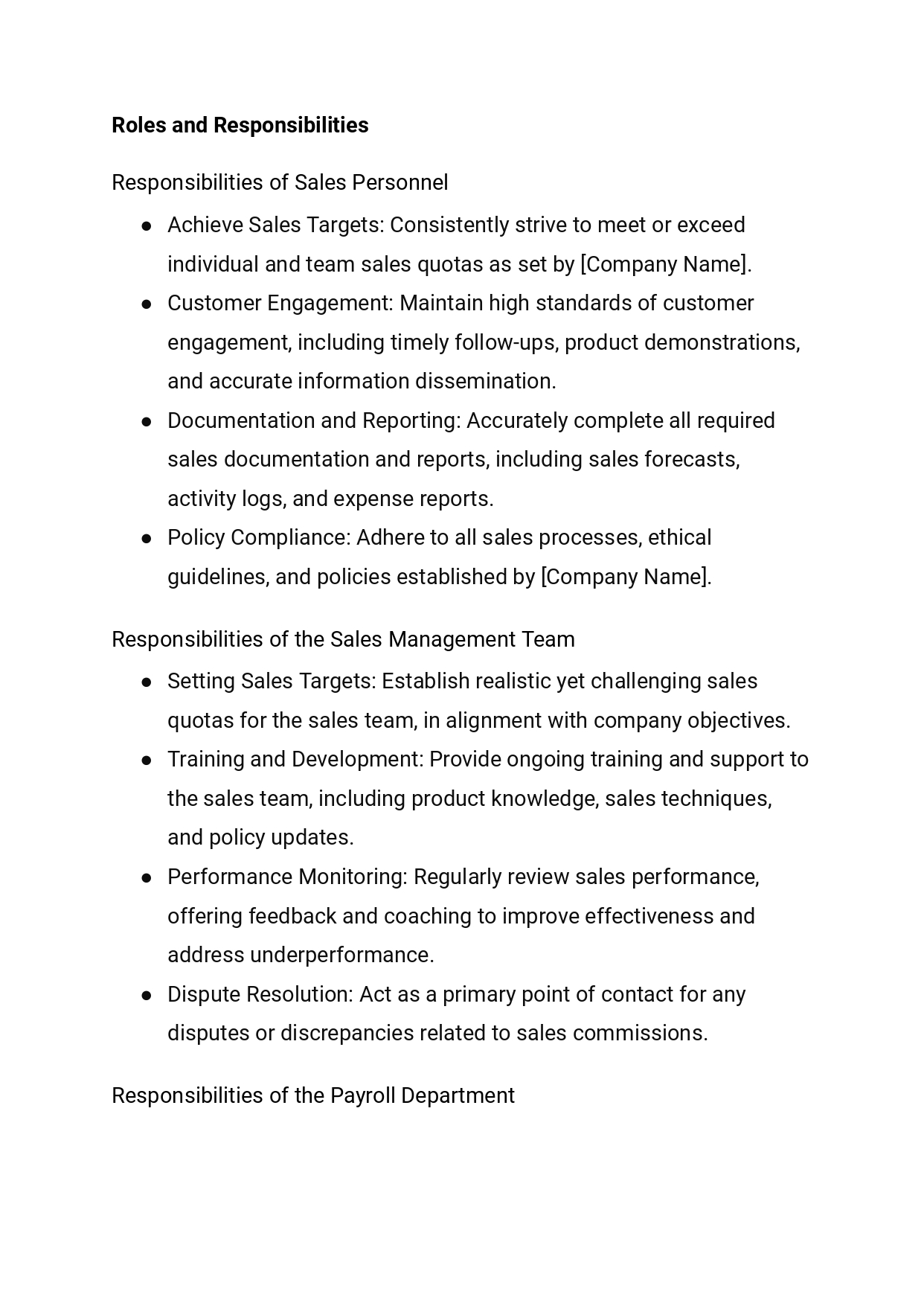

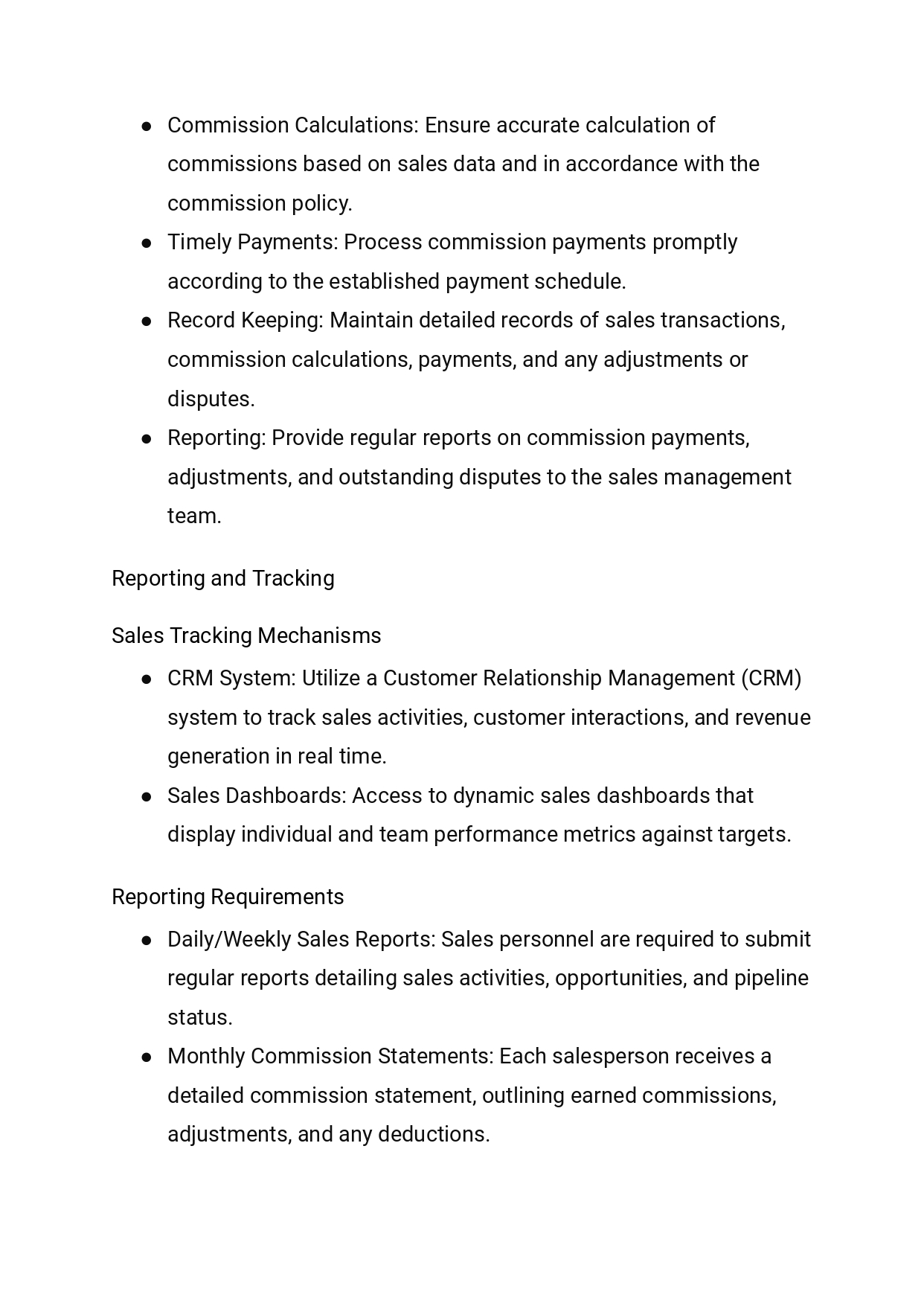

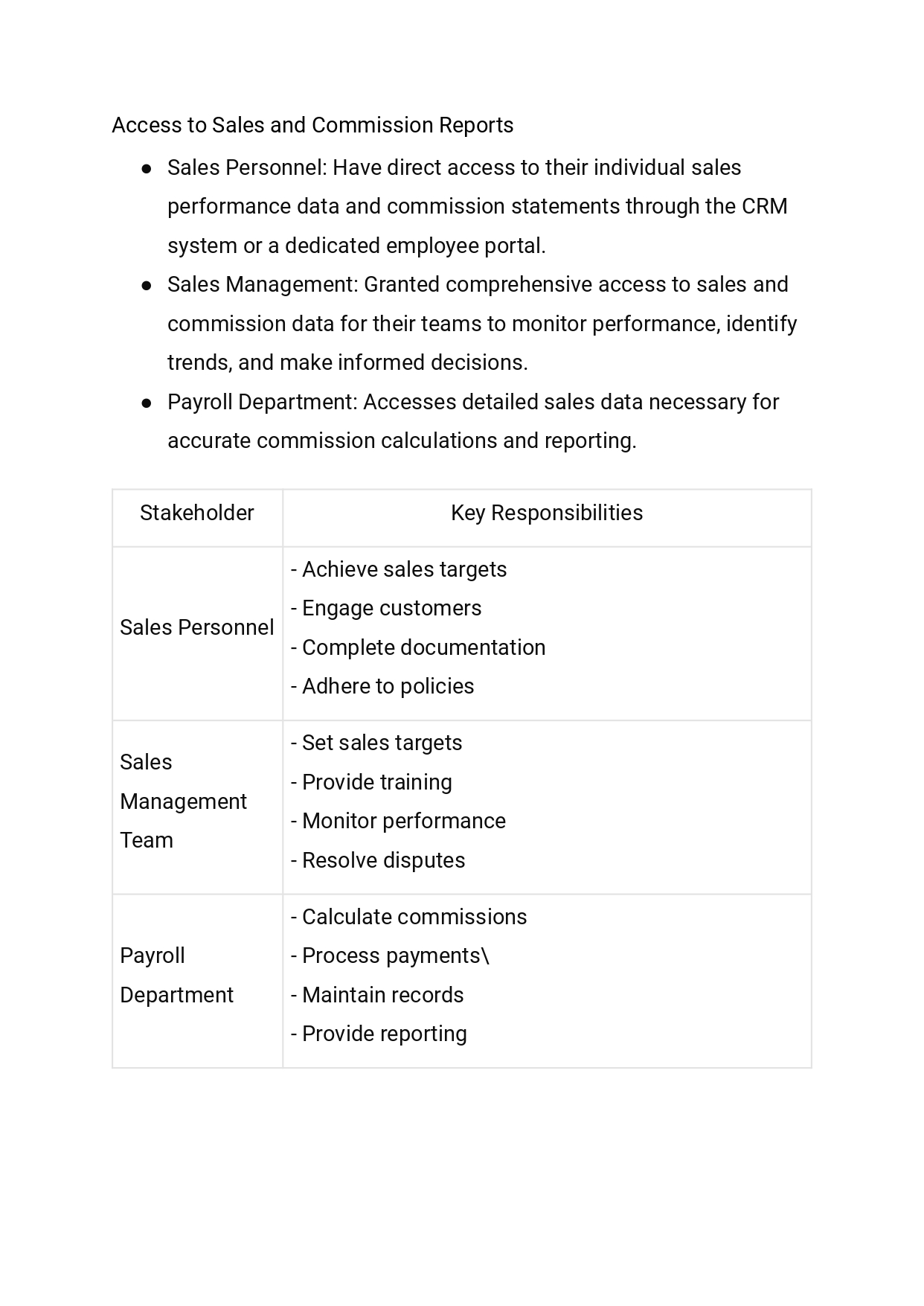

Sales Commission Policy Agreement

A Sales Commission Policy Agreement is a formal contract that sets the terms and conditions under which an employee would get commissions from their business. This type of agreement is usually used for sales-related positions. In order to prevent misunderstandings between the employer and the employee, this kind of agreement plays an important role as it explains precisely how and when commissions are calculated and paid.

Key Elements of A Sales Commission Policy Agreement

Authorization:

This part of the agreement essentially gives the salesperson the green light to sell the company’s products or services, but it comes with a set of agreed upon terms of where, when or how they’re allowed to sell. This keeps everything orderly and makes sure that the salesperson’s efforts are in sync with what the company wants and expects.

Documentation:

In this part of the agreement, it’s made clear that a salesperson needs to stick to certain software, tools and methods that only the company approves of when they’re keeping track of their sales data. This means either using a CRM (Customer Relationship Management) system that the company provides or specific forms and sales documents that everyone is supposed to use. The reason behind this is to make sure that all sales activities and processes are recorded in a consistent way. This helps the company keep everything well organized and makes it easier to see how sales are going across the board.

Non-Compete Clause:

This part of the agreement helps keep the company safe. It sets rules so salespeople can’t sell things for other companies that might be competing with their own, not only while they work there but also for a certain time after they leave. This way, the company makes sure its secrets and customers are protected, keeping it ahead of the competition. It’s like a safety net for the company’s business secrets and customer relationships.

Non-Disclosure Clause:

This clause requires the salesperson to keep the company’s confidential information, like trade secrets or customer details, private. It helps protect the business’s valuable insights and maintains its competitive edge.

Commission Structure:

This section that is the main body of this contract that explains the specifics of how commissions are earned and paid. It needs to have information on:

- The criteria for commission calculation (e.g., a percentage of sales, performance-based tiers, etc.)

- The exact conditions for commission-earning sales

- When and how commission payments are made

Policies that explain how earned commissions are impacted by returns, cancellations, or non-payments, making sure that both parties are aware of the financial consequences of different sales situations.

Agreement:

In the final part of the agreement, both the salesperson and the employer officially agree to all the terms by signing their names and dating the document. This act of signing makes the agreement official and sets the foundation for their professional relationship according to the agreed-upon rules.

Sample Sales Commission Policy

You can create your own sales commission policy by using this sample as a guide. This sales commission policy template makes it simpler for you to draft a policy to promote a motivated sales force and boosts the success of your business for sales commission payments.

Conclusion

A well-thought-out sales commission policy is crucial for bringing in and keeping the best salespeople. When you make it clear how they can earn their commissions, it helps everyone understand what’s expected of them. This clarity boosts motivation and makes your team stronger, setting your business up for steady growth. In the end, a good commission plan isn’t just about paying out; it’s about building a team that’s driven to succeed, which is great for your business’s future.

To further empower your sales team partner up with Smart Sales Kit. Our toolkit packs over 3000 sales documents, including top-notch sales commission policies, to streamline your processes. It’s your go-to for effective sales commission policies that fit perfectly with your sales plans. Ready to upgrade your sales operations? Check out the Smart Sales Kit on our site and start refining your commission policy now.